Article content:

When paying for goods from China, it's important to choose a secure solution for transferring funds. The market offers several payment instruments, each with its unique characteristics and terms of use. Today, let's take a closer look at several payment systems trusted by businesses worldwide.

When transferring money to China from Ukraine, several important factors should be considered:

Below is a detailed overview of payment systems worthy of your attention when organizing international payments.

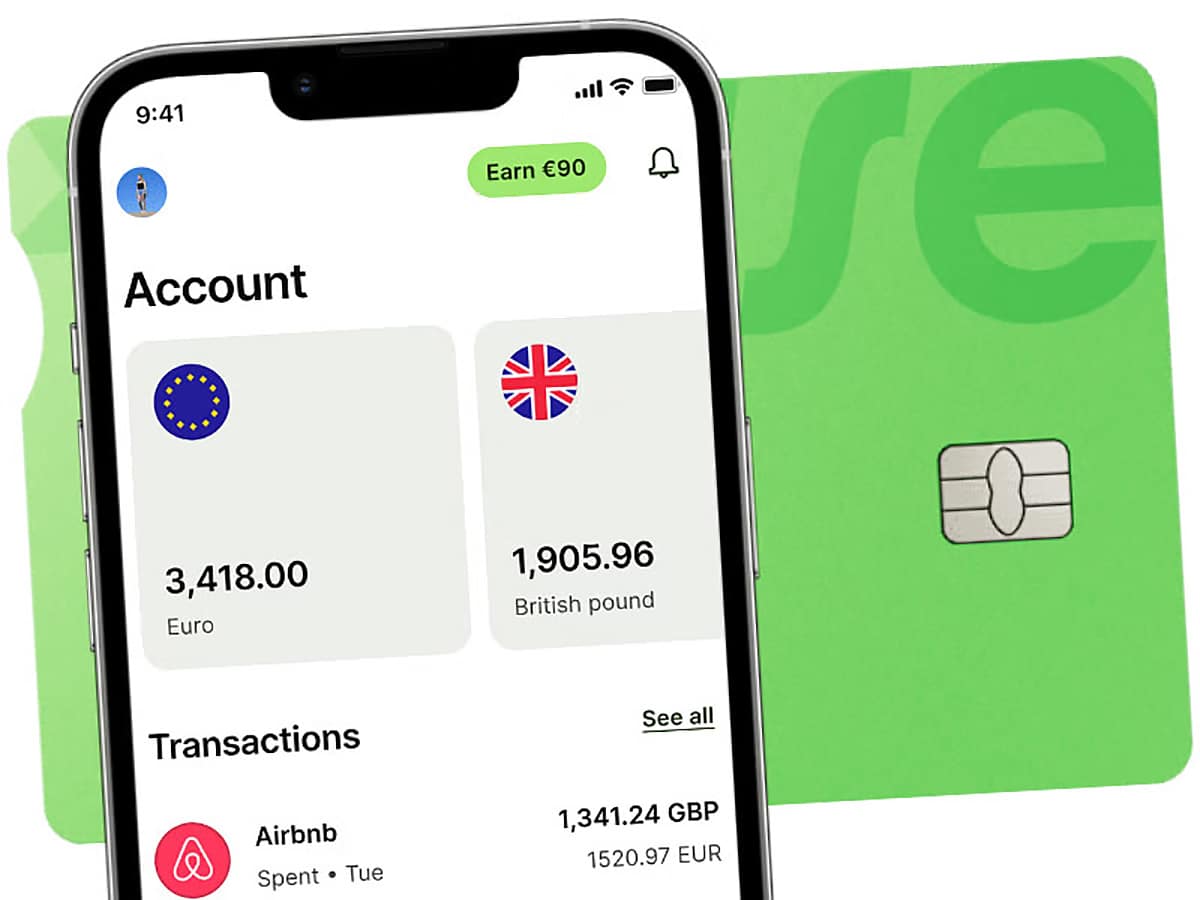

Wise is one of the most well-known platforms for international money transfers, trusted by over 16 million people. Strict supervision by the UK Financial Conduct Authority (FCA) ensures a high level of trust and security among its users.

The transfer limit is 50,000 CNY or 7000 USD, with a maximum commission of 90 USD. The speed of receipt varies from a few hours to three business days.

System advantages:

Disadvantage – complex document verification.

You can pay directly in the mobile application

The Union Pay system is a reliable and convenient way to transfer funds both within China and beyond its borders, covering over 180 countries.

Union Pay sets a daily limit on transfers of 2000 USD, with a monthly maximum of up to 50,000 USD, making the system ideal for both periodic and significant financial transactions. The transfer fee consists of 0.7% for banking services and an additional 0.1% for service charges, not including potential additional expenses.

The company particularly ensures that Swift transfers are made within one business day.

Advantages: reliability and a loyalty program for users.

Disadvantage: high currency exchange commission.

UnionPay is China's largest payment system

This payment system is among the top thousand fastest-growing companies of 2023. Its activities are regulated by the FCA, ensuring reliability and security.

Paysend offers users simple but important conditions: unverified accounts can make up to three payments totaling up to 500 USD within a three-month period. After verification, users can make up to 100 transactions totaling up to 15,000 USD in a similar period. Regardless of the amount, the commission is 1.99 USD per transfer. Transactions are processed within a few hours to three business days.

The advantage is the ability to make instant transfers.

Disadvantage: complex verification process.

Paysend allows you to send money online to any bank in China

This system operates in more than 200 countries worldwide and has a high level of trust. Clients who have not passed verification can send up to 3000 USD, while for verified users, the limit increases to 50,000 USD. Special attention should be paid to the commission. For international transactions, it ranges from 35 to 50 USD, but there may be additional expenses.

Advantages: has many physical branches in Ukraine.

Disadvantages: four types of commissions.

Transferring money to an account in a Chinese bank is an excellent option for those who value the stability and security of their financial transactions. Banks are regulated by the state, which in some cases is an additional guarantee of security, especially when transferring to another individual's account.

Transfer limits and time conditions need to be clarified on the website of each specific bank, as they vary.

Advantages: regulated by more instruments than payment systems.

Disadvantage: for some transfers, tax documents are required.

To pay for purchases from China, you can use our "Pay with Friend" service, which saves a lot of time in solving logistics and payment system search issues. The payment limit can exceed 25,000 yuan depending on the clients' needs. We also help with finding products from China on the most popular marketplaces on favorable terms.

The global banking system has made money transfers from Ukraine to China an accessible service: transfers to a card, a bank account, or via payment systems. However, not everyone can navigate these options, as there are many methods, each with varying fees, limits, and transaction times. If you don't have the time or desire to compare different transfer methods and choose the best one for you, contact us at DiFFreight. Over the past year, we have processed thousands of payments for our clients from Ukraine, relieving them from complex financial transactions.

How does it work? You select a product on a Chinese website, place an order, and send it to us for payment processing. From there, we take care of everything for you. In addition to assisting with payments to suppliers, we offer the following services: finding reliable suppliers, purchasing products, delivering goods from China to Ukraine, inspection in China, warehousing services, and more. To learn about the cost of our services, get a professional consultation, and discuss cooperation, contact our managers. With us, you can quickly and easily receive your shipment with minimal time and cost.