Article content:

When transporting goods across the borders of the European Union, companies are regularly faced with the need to issue an EX-1 export declaration. This document not only confirms the legitimacy of the export of goods, but also serves as a key element in the coordination of customs and trade procedures. In the article, we will consider in detail what an export declaration is and talk about the specifics of its preparation.

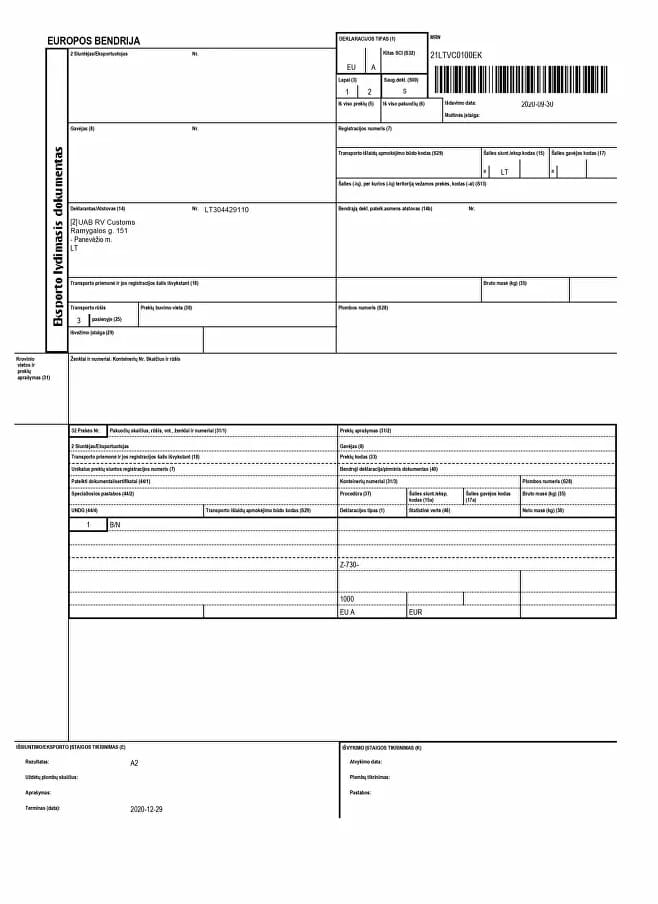

The EX-1 export declaration is an official document that confirms the exporter's intention to export goods outside a certain country or customs union. It contains detailed information about the product, its quantity, origin, destination, cost, as well as about the exporter and importer.

On the basis of the declaration, the customs office determines which customs duties and taxes must be paid, and also checks compliance with all other requirements for the export of goods.

The European Union is a customs union consisting of 27 member states. When transporting goods across Europe, they do not require customs clearance. However, when exporting goods outside the EU, an export declaration must be issued. It is primarily needed by the sender, as VAT is reimbursed on its basis.

Special equipment is used for grinding: cranes, loaders, conveyors, etc

One of the primary reasons for the necessity of processing an export declaration is to comply with legislative requirements. This document is crucial for adhering to regulatory standards and ensuring the unhindered movement of goods across borders.

The declaration is submitted in electronic form. It can be submitted by the exporter himself, his representative or a customs broker.

Step 1. Preparation of documents

To prepare the EX-1 declaration, you need to collect a number of documents that confirm the characteristics of the product, its value, origin and other important aspects.

A general list of typical documents that are usually required:

Importantly. The specific list of documents may vary depending on the legislation of the exporting country and the type of goods. Therefore, before starting the export declaration, you need to check the current list of documents with the customs authorities of the exporting country.

Step 2. Filling out and submitting the declaration

The exporter, his representative or customs broker fills out the declaration in detail, indicating all the necessary information about the product, its value, destination, vehicles, transportation route, etc.

The cargo receives marks from radiology, phytosanitary services, etc. In cases where the cargo is not subject to phytosanitary or radiological control, marks are made automatically.

The declaration is then submitted to the relevant customs authority.

The export declaration is submitted electronically through the Export Control System (ECS)

Step 3. Cargo inspection

At the customs point, the cargo is checked and the declaration is processed. Then the cargo receives permission for export. When the goods cross the borders of the EU, the export declaration is closed.

Each of these steps requires compliance with specific norms and rules established by the legislation of the exporting country. The DiFFreight company is an expert in international cargo transportation, so it has the necessary experience and knowledge to ensure the correct and timely execution of the export declaration. If you have questions or difficulties with cargo registration, contact us, we will always help.

Export declaration procedures have become more digitalized. In China, electronic submission of documents is mandatory, and a traceability system has been introduced for high-tech goods and minerals. Exporters are required to confirm the entire chain of origin in electronic form.

In Europe, a carbon tax has come into force — emissions reporting is now required even for exported goods. The main trend of 2026 is stricter control over the accuracy of product descriptions. Knowledge of local specifics is critically important for successful customs clearance.

Most mistakes are accidental and caused by inattention. Let’s look at the typical ones often made in the export declaration:

| Problem / Error | Consequences |

|---|---|

| Errors in exporter/importer names or data | This may prevent automatic registration and cause delays. |

| Incorrect HS code (Commodity Code) | This error can lead to customs delays, recalculation of duties, and fines. |

| Missing exit customs office | The number must be indicated in the “Exit border from EU” field. This refers to the checkpoint through which the cargo leaves the EU territory. Without this number, it’s impossible to receive export confirmation, which means the exporter cannot apply zero or reduced tax rates. |

| Inaccurate product description | It’s important to fill in the information briefly but precisely, specifying the composition, model, brand, packaging, and purpose. Too general descriptions may raise customs suspicions. |

| Incorrect quantity of goods / understated value | This is the most critical mistake: if the actual quantity is higher or the price is significantly understated, it can be considered an attempt at fraud (undeclared goods or intentional duty evasion). |

The process of preparing an export declaration is quite complex and requires a significant amount of time. However, you can speed up and simplify this process by contacting DiFFreight Company.

An export declaration is an official document confirming that goods are leaving a country. It is required for customs control and allows legal export of cargo.

The declaration should be submitted before the goods physically leave the country — typically a few days before shipment. This helps avoid customs delays and ensures on-time delivery.

Common errors include incorrect HS codes, inaccurate quantity or value, and missing certificates. These mistakes can lead to customs delays, fines, or cargo being returned.

It’s advisable to work with an experienced customs broker or logistics partner (such as DiFFreight), verify codes and documents carefully, and ensure accuracy before submission.