Article content:

If you purchase goods abroad, for example in China, the main document of the transaction is the Invoice. It must be available when crossing the border and is important for accounting and international trade as a whole. We explain what an invoice means, where to get it, and why accuracy down to the letter is essential.

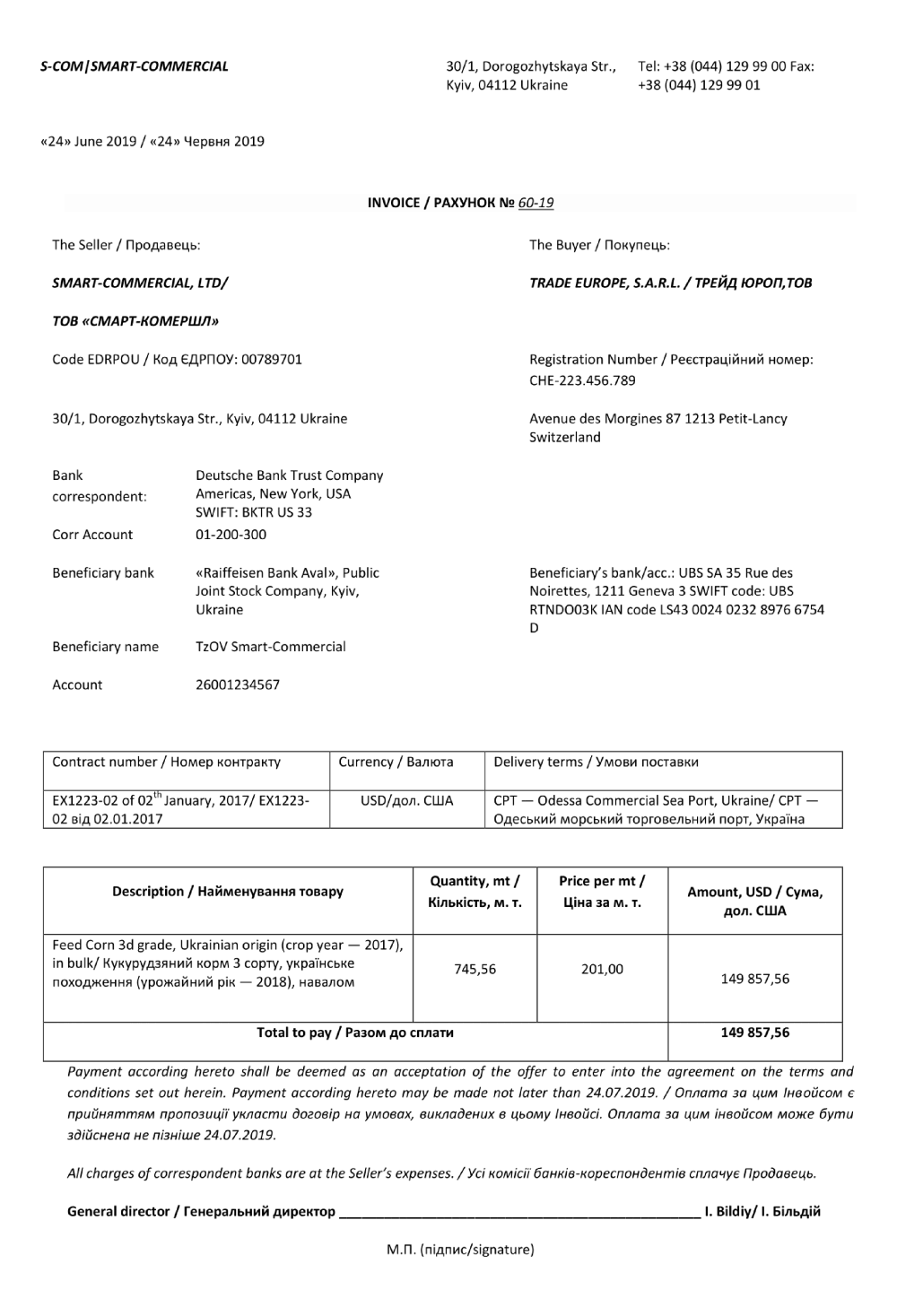

An invoice, also known as a commercial invoice, is a payment receipt that confirms the fact of purchase from a specific manufacturer. There are two types of this document:

What the document includes:

Where to get an invoice? It is prepared and filled out by the supplier (seller) of the goods in electronic. If the invoice is on paper, 5 copies are made. One is attached to the cargo, the second — to the waybill, and from the remaining three copies one is given to the exporter, one to the recipient of the cargo, and one to the logistics company.

If the shipment is made by a legal entity, the invoice is certified with a seal and signature; if by an individual — only a signature is required. During international logistics services, the document is filled out in two languages (English and the language of the destination country).

Invoice example:

For repeated transactions, they take an already completed invoice with the parties' details and change only the product information. The template significantly simplifies and speeds up the procedure.

Together with the invoice, a packing list is also submitted.

If you are the buyer, it is important to check the data, since you are not the one filling out the document. This is a mandatory step! All information must correspond to the actual volume of the transaction with an accuracy of one unit, and the data — with an accuracy down to the letter.

What to pay special attention to:

Verification before cooperation is a desirable step if you are working with the seller for the first time. Conscientious suppliers usually fill out all documents correctly under the agreed terms.

When the supplier issues the invoice, you must make the payment in the currency and method agreed upon. Payment methods:

International invoice payments are more complicated than a regular card-to-card transfer. DiFFreight will help you pay the invoice in several ways:

Contact us for payment services: we will recommend the most cost-effective method and process the payment without delays.

The main problems arise not during export, but at the stage of customs clearance of the cargo for import (customs clearance) at the internal customs office in Ukraine. It is here that the customs authorities thoroughly check and monitor the compliance of the goods and documents that you are importing. If discrepancies or errors are found during the inspection, the consequences may be as follows:

Thus, you may not only pay up to 100% of the invoice amount as a fine, but also lose the goods entirely without compensation.

Separately, let's talk about the importance of the invoice for customs clearance. The amount stated in it is the first and main method for determining customs value. Based on this value, along with other payments, duties and taxes are calculated. Proof of payment is important if customs officers want to adjust the value upward.

To avoid such situations, we recommend customs brokerage services. Our brokers will check and prepare all necessary documents for successful customs control.

An invoice is a kind of “report” that indicates the quantity of goods, the parties to the transaction, its terms, and the amount. It is important for accounting, foreign economic activity, and customs clearance, since the duty and tax rates are formed based on the invoice amount. Be very careful when receiving the document from the supplier. If you want to avoid stress, trust DiFFreight — we have extensive experience working with invoices and will successfully complete customs clearance.

An invoice is a commercial bill that contains a detailed description of the goods, quantity, price, and shipping terms. It is needed for customs clearance, verifying the value of the shipment, and confirming the agreement between seller and buyer.

The invoice must include: product name, description, quantity, unit of measure, unit price, total value, country of origin, seller and buyer information, and invoice date. This ensures correct product classification and duty calculation.

An invoice reflects the financial side of the transaction: pricing, quantity, terms. A packing list provides details about packaging: boxes/pallets, weight, dimensions, number of packages. Both documents are required for proper customs clearance and logistics.

If the invoice has incorrect information — wrong price, quantity, or product classification — customs may delay the shipment, impose fines, or refuse clearance. Therefore it’s important to review all details before shipping and reissue the invoice if needed.