.jpg)

In international logistics, it is very important to understand how risks and responsibilities are distributed. This is precisely what the Incoterms rules were developed for — trade terms that standardize agreements between parties. CIP (short for Carriage and Insurance Paid to) is the topic of today’s article from DiFFreight experts.

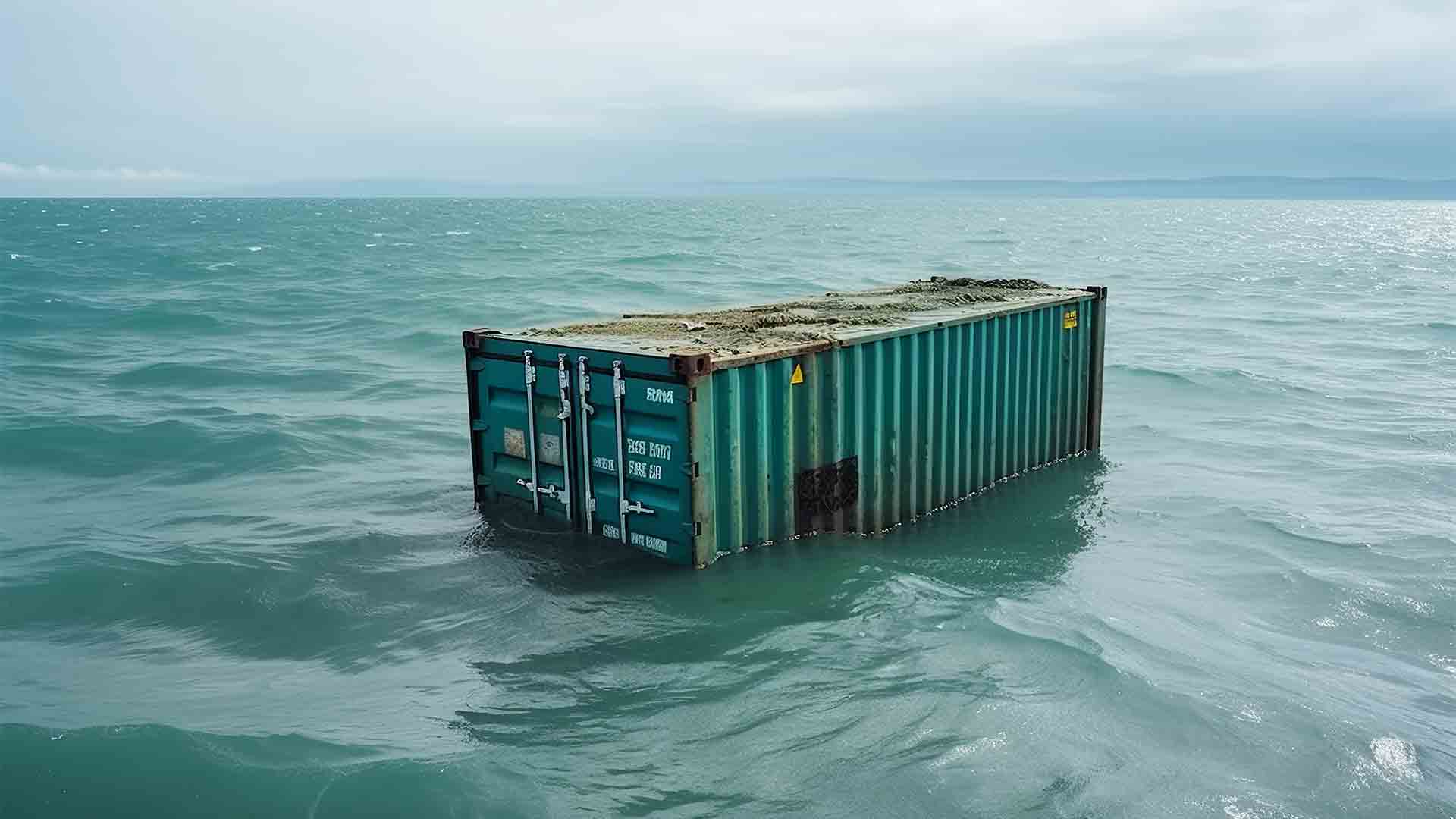

CIP delivery is an Incoterms term in which the seller undertakes the organization and payment of transportation and cargo insurance to the destination point. The risk transfers to the buyer when the goods are handed over to the first carrier.

Let’s say a Polish company sells equipment to a client in Brazil under CIP terms. The seller handles export clearance, packages the equipment, hires a logistics company, takes out insurance, and hands over the cargo.

During transshipment, part of the cargo is damaged. According to CIP, the risk had already transferred to the buyer. But the supplier had arranged insurance, so the client in Brazil will receive compensation.

CIP delivery terms apply to all types of transport, including multimodal shipments.

Seller’s responsibilities include:

Note: in case of a claim, the consignee submits the insurance claim.

Buyer’s responsibilities:

CIP Incoterms provide that the seller bears the following costs:

These Incoterms conditions are favorable for small and medium importers, buyers who do not want to organize logistics or insure cargo themselves. CIP also works well for multimodal transport, since it is the seller’s responsibility.

This service is not beneficial for consignees with their own logistics or for exporters who do not want to incur additional expenses. If a client wants the seller to bear the risk longer, DAP or DDP would be better.

The rules are updated about once a decade. The essence of Incoterms remains the same, but each edition includes clarifications. The 2000 and 2010 versions specified insurance with minimum coverage (ICC C).

The CIP Incoterms 2020 edition requires the seller to provide insurance with maximum coverage — ICC A. This is often called an “all-risks” policy, although there are exceptions (e.g., poor packaging, acts of war).

Key challenges you may face:

Many buyers mistakenly assume that risk transfers upon arrival. However, it's crucial to read the agreement carefully to understand when you become responsible for the goods.

Even with ICC A coverage, the insurance may not cover all potential losses (e.g., force majeure or delays).

DiFFreight recommends requesting a copy of the insurance policy and, if needed, arranging additional insurance. These extra costs will be your responsibility.

You can't influence which carrier the supplier selects.

We recommend including clear requirements for the transport company and agreeing on key delivery terms with the seller.

Errors in documentation can lead to customs delays and fines.

Clearly define the list of required documents, their deadlines, and how they will be transferred between parties. Engage a customs broker — a third party that handles customs clearance during import procedures.

Incoterms should be selected based on logistics, control, and cost-efficiency — not habit or templates. DiFFreight has years of experience in international logistics and will help you choose the best terms for your shipment, depending on:

CIP terms are generally more expensive than those where the seller does not handle logistics or insurance. Some practical tips:

CIP is a flexible solution for international trade. If you want to shift responsibility for transport and insurance to the seller, it's the ideal choice. But it’s important to understand each party’s obligations during the transaction. Trust DiFFreight’s professionals with your cargo management and logistics — schedule a consultation today!

CIP (Carriage and Insurance Paid to) means the seller pays for freight and insurance to the agreed destination. Risk transfers to the buyer once the goods are handed to the first carrier.

The seller pays for transportation to the named place and is required to provide minimum insurance coverage. The buyer is responsible for costs after delivery at destination.

Risk transfers to the buyer at the point when the goods are delivered to the first carrier, even though the seller pays to bring the cargo to the destination.

CIP is commonly used in multimodal transport (air, road, rail, sea) when the seller arranges freight and basic insurance coverage to the named location.